what is the inheritance tax rate in virginia

Virginia estate tax. Your average tax rate is 1198 and your marginal tax rate is.

Capital Gains On Inherited Property

This chapter shall be known and may be cited as the Virginia Estate Tax Act Code 1950 58-2381.

. Click the nifty map below to find the current rates. The rate threshold is the point at which the marginal estate tax rate kicks in. For any prize over 5000 the Virginia Lottery automatically withholds 24.

The tax shall be withheld on the entire amount of the prize not merely the amount in excess of 5000. Gift tax and inheritance tax in West Virginia. Hawaii and washington state have the.

The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. The tax is assessed at the rate of 10 cents per 100 on estates valued at more than 15000 including the first 15000 of assets. There is no gift tax in West Virginia and this fact became an essential part of the estate planning strategy for people with.

In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. But just because Virginia does not have an. The tax rate varies.

The estate tax was imposed on the transfer of a taxable estate at a rate equal to the maximum amount of the federal credit for state estate taxes as it existed on January 1. If you are considering your estate plan or have recently received an inheritance and need more information contact me Anna M. West Virginia is fairly tax-friendly for retirees.

Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. Overall West Virginia Tax Picture. For example the tax on an estate valued at 15500 is.

Virginia does not have an inheritance tax. What is the difference between an inheritance tax and. If you make 70000 a year living in the region of Virginia USA you will be taxed 12100.

The tax is assessed at the rate of 10 cents per 100 on estates valued at more than 15000 including the first 15000 of assets. Unlike the federal government Virginia does not have an estate tax. Virginia Income Tax Calculator 2021.

Price at Jenkins Fenstermaker PLLC by. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. This is great news for Virginia residents.

How To Pass On Inheritance To Your Children Los Angeles Times

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

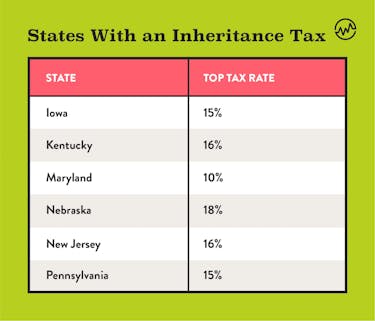

States With An Inheritance Tax Recently Updated For 2020 Jrc Insurance Group

Virginia Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax Here S Who Pays And In Which States Bankrate

What To Do And Not Do With An Inheritance

401 K Inheritance Tax Rules Estate Planning

South Carolina Estate Tax Everything You Need To Know Smartasset

Inheritance Tax Here S Who Pays And In Which States Bankrate

Do I Pay Taxes On Inheritance Of Savings Account

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Is Your Inheritance Considered Taxable Income H R Block

How To Avoid Estate Taxes With A Trust

The Curious Task Of Redistributive Taxes Inheritance And Corporate Taxes Berkeley Political Review

Top Real Estate Company In St Kitts Nevis 2021 Top Real Estate Companies Interior Design And Real Estate Real Estate